Stay current. Stay compliant.

Online Continuing Education Courses For

Investment Advisers

STC is an approved provider of IAR CE courses for registered IARs of state-registered and federally covered investment advisers subject to the NASAA model rule.

STC continues to monitor the latest developments and state adoptions of the NASAA IAR CE Model Rule. This rule requires Investment Adviser Representatives (IARs) to complete 12 CE credits annually to maintain their IAR registration. The requirement includes six credits of Products and Practices content and six credits of Ethics and Professional Responsibility content.

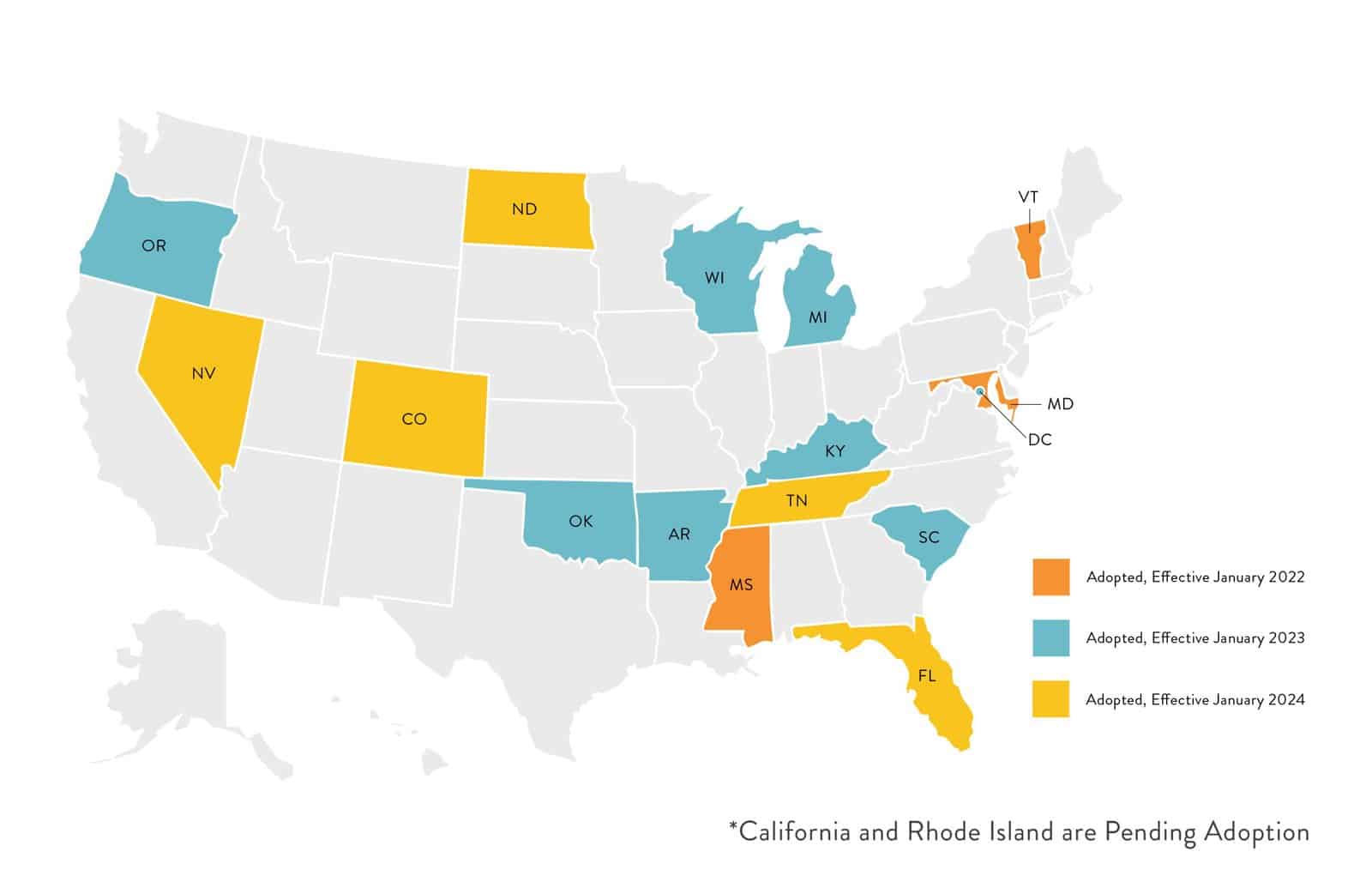

The NASAA Model Rule is being adopted on a state-by- state basis, but states are not required to adopt. The map to the right shows each state's adoption status of the model rule. State's highlighted green on the map have officially adopted.

Learn IAR CE from the Industry’s Best

STC is the securities licensing training provider that Wall Street (and beyond) has relied on for more than 50 years.

We have the experts that clients need to quickly and efficiently complete your required education.

Expert Course Content

Courses designed by expert instructors with over 50+ years of experience.

Guided Course Selection

Quickly select the correct courses to complete the IAR CE requirement.

Quick Completion

Our approved selection of IAR CE courses only take one hour to complete.

Complete IAR CE Requirements with STC

As an approved NASAA provider, STC currently offers 30 courses, as well as both six-hour and 12-hour bundles. Popular courses in our current course catalog include:

Advising Senior Investors

This module will examine some of the special considerations and warning signs when dealing with senior investors. Through the use of timely case studies, users will gain insight into the best practices when providing advice to these investors.

Ethical Decision Making for IARs

Through the analysis of current issues and case study application, users will gain an understanding of how a person’s behavior and attitude can impact the integrity of the industry. Topics include insider trading, best execution, and political contributions.

IARs - Dealing with Customers

This course will describe the brochure rule, acting as a solicitor, and the creation of advisory contracts. Additionally, the ethical importance of making suitable recommendations will be reviewed, along with rules regarding advisory advertising and correspondence.

Insider Trading and Investment Advisers

Insider trading and the potential misuse of material, non-public information (MNPI) have been a consistent focus of the SEC’s examination and enforcement programs. After an examination of recent regulatory actions, users will be presented with case studies to gain an understanding of appropriate and ethical responses.

IAR CE Requirements

We’re here to guide you in the new IAR CE requirements. Here are common FAQs:

Investment Adviser Representative Continuing Education (IAR CE) is a type of professional education that is required for individuals who are registered as Investment Adviser Representatives (IARs). The purpose of IAR CE is to ensure that registered IARs maintain and improve their professional knowledge and skills related to investment advising. The continuing education requirements vary by state, but typically include courses on ethics, securities regulations, and investment-related topics.

Investment adviser representatives (IARs) are required to complete 12 CE credits annually to maintain their IAR registration. The requirement includes SIX credits of Products and Practices content and SIX credits of Ethics and Professional Responsibility content.

An IAR who’s also a registered representative of a FINRA member firm and in compliance with FINRA’s Regulatory Element CE requirements is considered to be in compliance with the requirement to complete SIX credits of Products and Practices content. In other words, these IARs are only required to complete the SIX credits of Ethics and Professional Responsibility content.

Most financial professionals are required to complete ongoing learning to protect themselves and their clients. Research shows that, the amount of assets under management has fluctuated recently between $110 trillion and $140 trillion. Much of this money can be attributed to the retirement savings of millions of Americans. This has resulted in the rapid expansion of the investment advisory profession. In fact, the number of registered investment advisers has steadily increased. All of these factors point to an opportunity and a need to support the important role that IARs play in their clients’ financial lives. The acquisition of knowledge in the form of continuing education is just one way to support IARs.

All Investment Adviser Representatives (IARs) registered in a jurisdiction that implements the model rule will be required to comply with its Continuing Education (CE) requirements. This applies to all registered IARs, regardless of whether they are state-registered or federally covered investment advisers, in that jurisdiction.

One difference is in the reporting of course completion. Approved providers of IAR CE are required to report completions directly to FINRA—NASAA’s vendor for program tracking.

FINRA will update the IAR’s CRD profile to include the CE completions which will be reflected in their FinPro account. The IAR can self-monitor course submissions by logging into this account.

Yes, every course must have an assessment that is at least 10 questions in length. It is also required that IARs pass assessments with a score of at least 70% within no more than three attempts.

If someone does not receive a passing score in three attempts, they are required to retake the course prior to their next three attempts.

In order to receive credit, each IAR CE course taken must have a unique course ID. Duplicate courses will not be considered towards the IAR CE requirement, even if taken in a different year. However, if a duplicate course has been updated with a new course ID, the IAR will receive CE credit for the updated course. Some courses may be updated and retain the same name, but if the content has significantly changed, a new course ID will be assigned by the provider. In such cases, the IAR can take a course with the same name or instructor if it has a new course ID.

Yes, the reporting fee is $3.00 per credit, and it is paid by the approved CE provider when the completion is reported to FINRA.

An IAR who completes more CE credits than are required for the year may not carry forward excess credits into a subsequent year.

Yes, any course completed in the current year would first count towards the previous year if the IAR had a deficiency. For example, an IAR with a deficiency in 2022 completed a course in 2023. This would first count towards any deficiency in 2022.

If you are registered as an IAR in a state which has adopted the model rule, the CE requirement begins the following year. For example, if I become registered in Maryland in 2023, the CE requirement would begin in 2024.

An IAR with a professional designation is still required to complete IAR CE. Once completed, these courses may be able to count towards the CE requirements of the professional designation.

Yes. A firm is able to leverage its FINRA Firm Element training as long as its courses are also approved for IAR CE. Additionally, some IAR CE courses may even qualify for CE for certain professional designations (e.g., CFP).